Learn About the Legal Process

Do you have questions? We’ve got answers. This resource hub will help you navigate everything from what to do after a vehicle accident to how to handle the medical bills that may follow.

For even more legal content, follow us on social media.

Filter by Topic

- All

- Bad Faith Insurance

- Bicycle Accident

- Bus Accident

- Car Accident

- Catastrophic Injury

- Child Injury

- Crime Victim

- Defective Product

- Events

- In The News

- Medical Malpractice

- Neck and Back Injury

- Negligent Security

- Pedestrian Accident

- Personal Injury

- Premises Liability

- Rideshare Accident

- Sexual Assault

- Shooting

- Slip and Fall

- Spinal Cord Injury

- Traumatic Brain Injury

- Truck Accident

- Uncategorized

- Webinar

- Worker's Compensation

- Wrongful Death

Navigating a personal injury case can be challenging, especially when you’re focused on recovering from your injuries. Knowing what [...]

If you’ve been injured in an accident because of someone else, your case depends on more than just proving [...]

How Medical Bills Are Paid After a Car Accident If you’re injured in a crash, one of the first [...]

It only takes a second. You’re headed to dinner with friends or family, the sun is just starting to [...]

Being hit by a car while walking, running, or cycling can result in life-altering injuries. In Georgia, pedestrian accidents [...]

Being in an accident is already a traumatic experience, especially for those who are seriously injured. If the driver [...]

If I had a dollar for every time a client told me they had “full coverage” auto insurance … [...]

When it comes to the question of whether or not personal injury settlements are taxable, the short answer is, it [...]

The Atlanta car accident statistics can be staggering when considering the number of accidents compared to the number of [...]

You must have a motor vehicle license in Georgia, which should be with you whenever you are behind the [...]

Navigating a personal injury case can feel overwhelming, especially when you encounter unfamiliar legal terms. Understanding these terms is [...]

How to Handle Medical Bills After a Car Accident? If you’re involved in a car accident in Atlanta, figuring [...]

Experiencing a car accident can be overwhelming, but following a clear checklist can help protect your rights and strengthen [...]

If you've been in a car accident, choosing the right lawyer is crucial for securing fair compensation. A knowledgeable [...]

Car accidents are unfortunately common, and misconceptions about what to do after an accident can affect your ability to [...]

After a car accident, your social media activity can have a significant impact on your case. Although it may [...]

There are several different road projects and Gwinnett County road closures currently underway. Some of these projects are more [...]

As the weather gets cooler, we enter a time of thrills and chills, which means that many of us [...]

Social media frequently exposes a large portion of our lives to the public. Seeing as insurance companies are tasked [...]

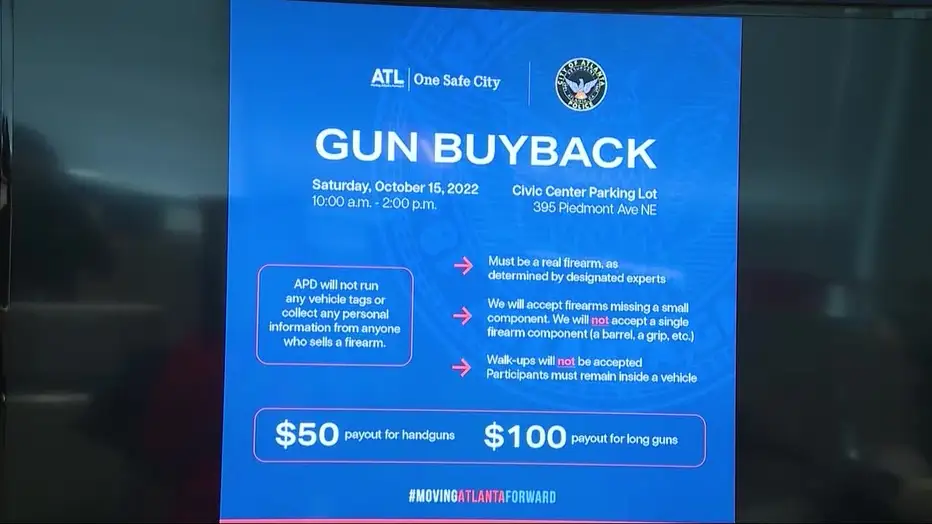

In recent years, gun violence and firearm-related deaths have increased throughout Georgia. Gwinnett lawmakers and law enforcement have taken [...]

The complex issue of gun-related violence continues to impact communities across the country, and Georgia is no exception. This [...]

Cars need catalytic converters to operate, but thieves see them as an easy way to make some profit. Because [...]

Peer-to-peer car rental is the latest development in the sharing economy movement, and it's rising fast with some experts [...]

Gwinnett County, one of the most populous counties in Georgia, is known for its intersections and thoroughfares that create [...]

The busiest roads in Atlanta are not only the most hectic in the South but are among the busiest [...]

Learning that a loved one has been shot is one of the most terrifying experiences anyone could ever have. [...]

Losing a loved one or suffering a terrible injury in a shooting can lead to an incredible amount of [...]

Unfortunately, the city of Atlanta is known for its crime rate, and according to Neighborhood Scout, there’s a risk [...]

Join us on July 14th, 2022, at 9:30am EST for the latest edition of the Rafi Law Firm monthly [...]

We settled our client Natasha's case 3 days before trial for 1.5 million dollars, which was a quarter-million more [...]

Personal injury law is complex, and many myths surrounding it can lead to misunderstandings and missed opportunities for fair [...]

Previously in this series, we discussed how to make the defense meet its burden. Part two covered “trade secret” [...]

When hiring an attorney, it is important to get to know the faces behind the names. Some law firms [...]

This week on the blog, we're taking a look at some of the most commonly asked questions about personal injury. What is [...]

In part one, we discussed how to make the defense meet its burden. Part two covered how to overcome proposed [...]

Mike Rafi, owner and trial lawyer at Rafi Law Firm, had the chance to speak with Courtney Barber and [...]

In the last part, we discussed how to make the defense meet its burden. In this part, we take [...]

Making the Defense Meet Its Burden – Attacking Defense Confidentiality or Protective Orders Part One

Many times, the defense will condition its production of key documents on your agreement to be bound by the defense’s [...]

In early August of 2021, the Georgia Supreme Court granted certiorari in Joyner v. Leaphart, 358 Ga. App. 383 [...]

On September 19, 2021, the National Highway Traffic Safety Administration (NHTSA) announced that it had opened an investigation into an additional [...]

Suppose you’ve been involved in a crash with a tractor-trailer, box truck, or another commercial motor vehicle (vehicles with [...]

Part of being a skilled attorney is staying abreast of new rulings and interpretations of existing law. In the [...]

The Supreme Court of Georgia just released a new opinion (Alston & Bird, LLP v. Hatcher Management Holdings, LLC) interpreting [...]

Personal injury claims can be complex and often come with misconceptions that can hinder your ability to seek fair [...]

Trucking cases are far more complex than car wreck cases. Not only are there potentially more responsible parties to [...]

Crashes involving trucks and 18-wheelers can have serious consequences. Previously, we have discussed the different types of vehicles that can [...]

As a personal injury client, you likely have little to no prior experience navigating the legal system. It can be [...]

When we think of accidents such as car or truck wrecks, our minds go to the physical injuries a [...]

After a car accident, an insurance adjuster will reach out and ask you for a recorded statement. The insurance adjuster [...]

For lawyers who represent injured people, some cases are much more challenging than others. For us, tough cases are [...]

The Story: On June 5, 2018, our client Eric was driving on Interstate 285 North in Fulton county on his [...]

The typical passenger vehicle weighs 3,000 to 4,000 pounds- many times greater than the average person. When an automobile [...]

It’s a fairly common occurrence to get into a car accident where no one gets ticketed. Thousands of car [...]

The late 1980s and early 1990s brought widespread adoption of an important safety advance to the vehicles we drive [...]

One of the most frustrating things we face as plaintiff’s lawyers is being constrained by insurance limits. The amount [...]

Unfortunately, no one is immune to injury when the people around them are careless. According to the Centers for Disease [...]

Biking can be a great way to get exercise, enjoy fresh air, and commute. However, riding a bike can [...]

The court in which the case is litigated is called the venue. In Georgia, injured plaintiffs have options when [...]

If someone’s spouse dies because of another person’s negligence, the surviving spouse can recover for the wrongful death of their [...]

If someone’s mother or father dies due to the negligence of another person, the children may be able to [...]

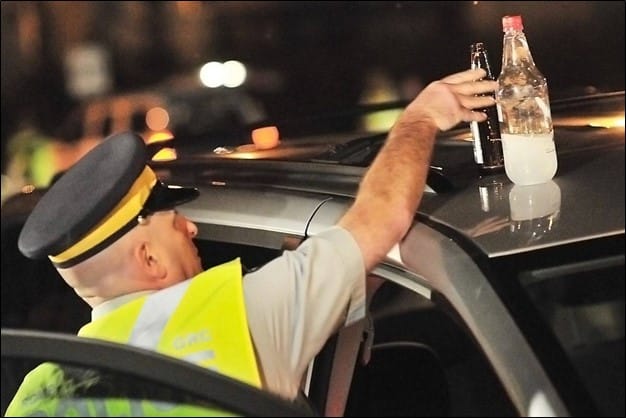

Any auto accident comes with its headaches, especially if you are injured and someone else is at fault. Drunk [...]

Crashes involving large trucks can end in serious injury or even death. It is common sense that the larger the [...]

Georgia law requires you to stop at the scene of an accident involving injury, death, or damage to a [...]

Nearly all lawyers offer a free first appointment, also known as a consultation. These meetings involve you describing your [...]

Truck accidents can cause major damages, and reaching a reasonable settlement can take time. Nearly all cases will take at [...]

We often take it for granted that our vehicles meet federal crash readiness standards. After all, a vehicle is [...]

A thorough investigation is crucial to any car accident claim. Effective investigations help establish fault, document evidence, and support [...]

In Atlanta, aggressive driving is responsible for an untold number of wrecks in and around the city every year. [...]

One of the most common questions we get asked as Atlanta personal injury lawyers is, “Where should I go get [...]

Generally, personal injury law is designed to provide victims of carelessness and negligence with the compensation they need to [...]

COVID-19, or what has come to be known as coronavirus, has changed the lives of millions of Americans in [...]

Wear your seatbelt, every time you get in a vehicle, whether you’re a driver or a passenger. According to [...]

The Story: On the evening of February 3, 2019, our clients’ father, TN, went to a convenience store in [...]

The world seemed to turn upside down when the news broke that Kobe Bryant, his daughter, and 7 others died [...]

Missing work is one of the many side-effects of getting injured. According to a 2013 study, an estimated $28 [...]

The “Exclusive Remedy” Rule and its Limited Exceptions If you are injured on the job in Georgia, the general [...]

Rafi Law Firm handles a lot of commercial motor vehicle cases. That includes cases against truckers, ambulance drivers, tow trucks, [...]

Georgia law requires a person working as a professional to conduct him/herself in a manner consistent with the standards [...]

We’ve all seen ambulances and firetrucks run through red lights when transporting a patient, and we’ve all seen police [...]

Understanding the concepts of liability and damages is essential for anyone pursuing a personal injury claim. Liability determines who [...]

According to a study by Legacy Services LLC, thousands of people are injured every year by faulty decks and [...]

Many property owners purchase homeowners insurance to protect their homes from a variety of perils like fire, lightning, hail, [...]

The vast majority of people have no experience with civil lawsuits. The procedural intricacies of how a lawsuit plays [...]

Americans love dogs. What’s not to love? Dogs are loyal companions who bring comfort and joy to millions of [...]

The Story: The morning of August 23, 2018 started like any other day for our client, RM—he woke up, [...]

Imagine you are driving through an intersection with a green light. All the sudden, a big pick-up truck driving on [...]

Cruises are big business. And just like with any big business, things happen and people get hurt. If you [...]

Generally, a person has 2 years to file a personal injury lawsuit in Georgia. This 2-year period is known [...]

When someone is killed by the negligent, reckless, or intentional conduct of another, multiple legal claims are created. Before [...]

From car accident cases to negligent security cases to everything in between, all personal injury actions in Georgia fall [...]

In November 2017, BuzzFeed News reported more than 180 women were sexually assaulted at Massage Envy spas across the [...]

Retired Major League Baseball slugger David Ortiz was recently shot at the Dial Bar and Lounge, a nightclub in [...]

Personal injury cases often involve individuals with unique health conditions, preexisting injuries, or vulnerabilities that make them more susceptible [...]

Negligent security cases take many forms. Some of the most common are when landowners and property managers fail to [...]

If you are injured after a car accident, you can likely recover from the at-fault driver’s insurance company and your [...]

Around 900,000 elevators are in operation on a given day. The average user takes 4 trips on an elevator [...]

Your decision to choose a new apartment is usually an exciting one, but you should temper that excitement with [...]

When I was a lawyer representing Fortune 500 retailers, apartment complexes, hotels, and other companies, they would always ask [...]

If you were injured due to the carelessness of a doctor, nurse, or other medical provider, you may have a [...]

Driving under the influence is a major issue on Atlanta’s roads. Though there are transportation options like MARTA, Uber, and [...]

One of the most common causes of car accidents is texting, or otherwise using a cell phone, while driving. [...]

Apartment complexes are supposed to be spaces where we can feel safe enough to call it “home.” Yet, there are [...]

The answer to this question depends on how you got hurt at work. Workers’ Compensation is a system allowing [...]

It’s no secret that semi-trucks cause issues every day on Atlanta’s roads and highways. At the very least, they [...]

The unfortunate answer--it depends. Moving trucks are dangerous Moving trucks are extremely dangerous for several reasons. First, just like tractor-trailers [...]

When the police are called out to the scene of a wreck, they do several things. First, they should [...]

A gunshot can have devastating effects not just on your medical health but also your financial health. Victims can [...]

Everyone wants to have fun. But sometimes, fun places like trampoline parks, amusement parks, and even TopGolf will argue [...]

FAST FACTS In 2016, there were nearly 180 fatal crashes involving semi trucks in Georgia. Atlanta has the highest [...]

Safety at school bus stops needs to be taken seriously by every parent and driver. Too often, people speed [...]

Large trucks were involved in 179 fatal road accidents in Georgia in 2016 An average tractor trailer can be [...]

Few people can say they've never had a stiff or sore neck. Many causes of this discomfort can be [...]

Rafi Law Firm settled a wrongful death case this month for $6,000,000. On July 30, 2016, Larry Grigsby was visiting [...]

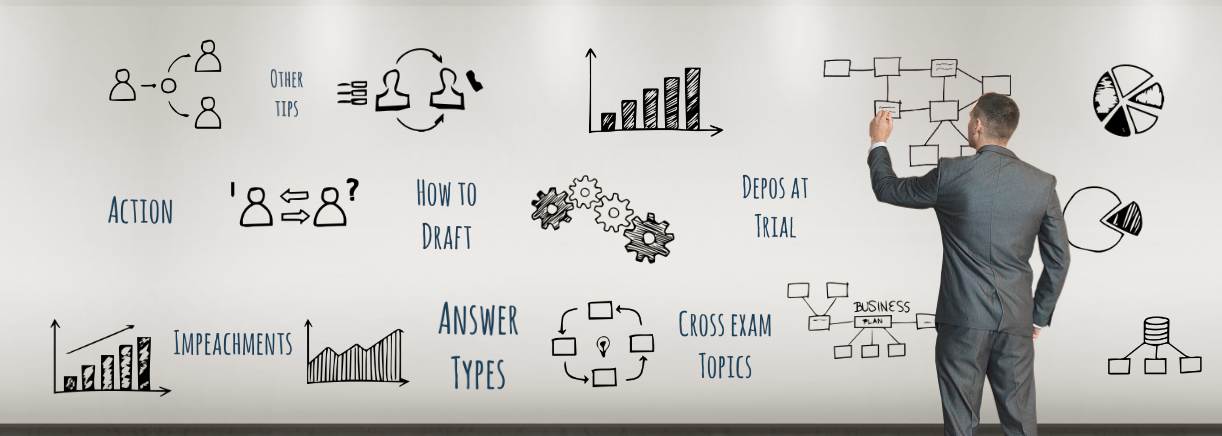

On March 14, Mike Rafi delivered a presentation to other lawyers entitled, "You Took Depositions, Now What? Using Depositions At [...]

Rafi Law Firm secured a $1,000,000 settlement for a client who was shot at an apartment complex on Buford [...]

Most of us love our UPS workers, especially this time of year. It seems as though most UPS employees [...]

Rafi Law Firm obtained a $1,700,000 jury verdict in Fulton County State Court for a Client who was shot [...]

A Federal Judge in Illinois recently found that a Hardee’s franchise may be liable for injuries suffered by a [...]

CNBC recently placed Georgia at number 2 in the nation in its annual Top States for Business rankings. One [...]

$2,000,000 settlement - the short story Our Client lost almost all of his right hand when a large industrial [...]

An early-morning power outage on September 25 is being blamed on a drunk driver. According to DeKalb County Police, [...]

Every month, you faithfully pay your health insurance premiums with the expectation that you and your family will be [...]

People in Atlanta, and around the rest of the country, love their pets. Many treat their dogs like human [...]

The Rafi Law Firm secured a $300,000 settlement for a client who was shot at an apartment complex in [...]

On August 17, 2017, a woman experienced what many people fear. She sustained a flat tire while traveling on [...]

Most people consider the police to be people we call for help when we are involved in an accident. In [...]

The Georgia State Patrol is conducting an investigation into a motorcycle accident that occurred on June 26. Officers responded [...]

A young woman in Ohio has recently passed away after contracting a brain-eating amoeba infection. The girl's parents believe [...]

A Georgia woman was arrested and placed behind bars after slamming her vehicle into a truck carrying chickens. When [...]

In one of the most tragic accidents of 2016, a man who was high on heroin drove onto a [...]

The Rafi Law Firm recently obtained a confidential six-figure settlement for the loved ones of a man who was shot [...]

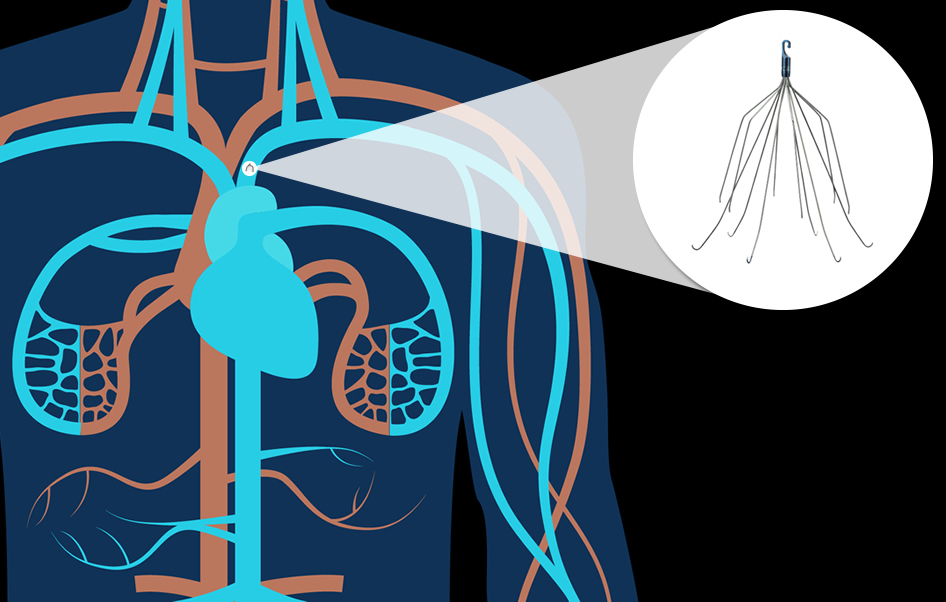

In the last few years, inferior vena cava filters ("IVC filters") have been the subject of more than 1,000 lawsuits [...]

This is the second post about making sure you have all the evidence you need for your case. In [...]

When you first file suit against a business or any other party, there are most likely many documents or [...]

Accidents involving tractor-trailers and other commercial vehicles are happening all too often. Recently, a Georgia truck driver was charged [...]

Imagine this: you suffered a back and neck injury in an accident that was not your fault, and then you [...]

There are 3 questions almost every client wonders after getting injured: 1) will I win my case? 2) how [...]

The Rafi Law Firm recently secured a confidential 6-figure settlement for a client who was shot at an apartment [...]

The Rafi Law Firm recently secured $575,000 for a client who was shot at an apartment complex in Decatur, [...]

Mike Rafi's article "This is An Out-of-Court Statement About Hearsay" was published in the Georgia Young Lawyer's Division Review. The [...]

Very recently, more than a dozen people were arrested for prostitution in Gainesville, Georgia. The arrests included several individuals [...]

An article written by Mike Rafi entitled "3 Tips to Winning the Jury with Your Opening Statement" was published in [...]

Research shows that apartments may be up to 85% more likely to be broken into than houses. While an [...]

https://www.youtube.com/watch?v=wSn3dyeYdX0 If I had a dollar for every time someone told me they had "full coverage" ... I [...]